A few years ago sales and discounts used to be very time specific. Our parents would usually wait for the Diwali sale or a new year's sale to make purchases.

But these days sales occur almost every month and discounts have become very common. I don’t remember the last time I went to a shopping mall and didn’t come across a 50% off sale tag.

But why do we keep hunting for discounts every time we make a purchase?

It is because people love to buy things at discounted rates. Not only it saves money but you can buy more at a lower price. Similar is the case with the stock markets.

Sometimes stocks are also available at discount. Stocks that trade at a discount or are undervalued are known as value stocks.

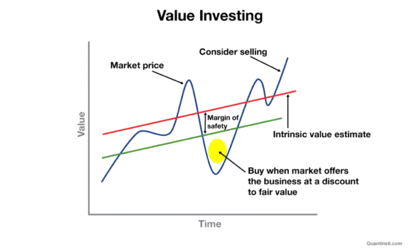

Value stocks have a high level of safety. It refers to the difference between the intrinsic value of a stock and the current price of the stock.

For example, it doesn't matter if you buy a TV at a discounted price or buy it at MRP. Its image quality will remain the same. Likewise, by buying shares at a discount or at their true value, the fundamentals of the company will be the same. So in value investing you focus on buying high-value stocks at a cheap price.

How does value investing work?

Value investing is a simple strategy. Let's understand this with an example. An investor finds a stock whose price is lower than its intrinsic value, which is the true valuation of the stock. If you choose a valuable company with strong fundamentals, the market price will soon appreciate and reach its true value. This is how value investing works.

Hence, the greater the difference between the true value and market price, the greater profits you will make in the long term.

Stock evaluators in the Market?

1. Market recession -

Generally, a stock is undervalued when the markets are bearish. A recent example of such a situation was when the capital markets were hit by COVID-19. A lot of stock was available at a discount. In such times of uncertainty, investors dump many stocks from their portfolios for fear of further losses. This can be a great opportunity to buy stocks that are undervalued.

2. News -

Many times the market reacts to adverse news that causes stock prices to fall. Negative news causes investors to sell stocks. The reason may be changes in interest rates or sectoral uncertainty.

3. Low price-to-earnings ratio (P/E ratio)-

A company's price-to-earnings ratio reveals the price of a stock in relation to the portion of profit attributable to that share of equity capital earned by the company. A high P/E ratio means that the stock price will be higher compared to its earnings. A low P/E, on the other hand, means higher earnings relative to the price paid per share. Value investors should look out for companies with low P/E ratios to maximize their gains.

4.Price-to-book ratio (P/B ratio) -

The price-to-book ratio is the ratio of a company's book value to its price per share. It is a metric of a company's financial strength and shows whether the company can generate profits in the future. A low market value compared to book value is a sign of the best undervalued stocks unless the company is facing a serious financial crisis.

5. Net cash flow

Companies are usually considered good investments if their reported earnings are large. However, some investors focus more on a company's net cash flow. Net cash flow is the cash flow remaining after adjusting for all outflows such as capital and operating expenses. Stocks with good net cash flow can, but with lower earnings, be priced low. However, in the long run, they can become a good business if the company uses that cash to expand operations, boosting its stock price.

6. High dividend yield

A company pays high dividends when it has no more opportunities to invest. Because of this, the company's share price may fall. This may be alarming to some investors, but it may also be a signal to investors that the funds available to pay dividends can help the company weather adverse market conditions. If other factors show that the company is not in immediate financial danger, investors can buy these shares and get some dividends now. They can also sell shares when the price rises in the future.

7. Low-debt stocks

Of course, low debt is a desirable feature of stocks, whether you're a valuation trader or not. Energy, steel, and infrastructure companies often have very high levels of debt, leading to an aversion to value traders. Companies with low debt and steady growth that can be seen in terms of earnings often carry undervalued stocks. The prices of such stocks are bound to rise in the future.

Conclusion

Traders who want to make long-term investments or those who can patiently wait for undervalued stocks to rise must choose such an investment approach. While this is not an exhaustive list, and none of the above factors are sufficient to confirm whether a particular stock is undervalued, together they can provide a clearer picture of a firm's stock valuation.

A powerful aspect of value investing is building financial models. Want to get more in-depth about how to do financial analysis of a stock? Join this live, hands-on workshop on the fundamentals of fundamental analysis. Register for free

1,499

1,499